New Delhi, June 2 (IANS) The Enforcement Directorate (ED) recently raided the premises of VIPS Group and Global Affiliate Business in Pune and Ahmednagar, which resulted in the seizure of assets worth Rs 18.54 crore under the Foreign Exchange Management Act (FEMA).

The mastermind behind these operations has been identified as Vinod Khute, who operates from Dubai and controls the business under the name of Global Affiliate Business through a mobile application.

The ED alleged that the companies were involved in running an unauthorised multi-level marketing (MLM) scheme, and had collected Rs 125 crore from different individuals and funnelled the funds out of the country using hawala channels.

The investigation has revealed that Khute orchestrated various illegal trades, crypto exchanges, and wallet services through the VIPS Group of companies, with the proceeds being transferred to foreign countries through hawala transactions.

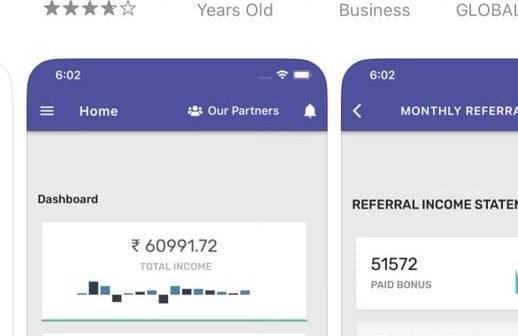

One of the key aspects of this illegal trade was the operation of Global Affiliate Business, which promoted affiliate marketing through an application called ‘Global Affiliate Business’, available on Google Play Store and Apple Store.

However, it was discovered that Global Affiliate Business was running unauthorised MLM schemes, where members who joined the programme and referred other consumers/clients would receive commissions.

Through this scheme, a total of Rs 125 crore was collected from numerous investors. Additionally, Global Affiliate Business was found to be marketing the business of Kana Capital, which engaged in brokerage service for forex, crypto, and stocks trading.

The ED also uncovered that Kana Capital, in collaboration with the directors of VIPS Group, conducted weekly training programmes for Global Affiliate Business clients, encouraging them to invest in VIPSWALLET.

Furthermore, Vinod Khute recently launched M/s D Dhanashree Multi-State Co-op Credit Society Limited in Pune, enticing investors with fraudulent schemes offering 2 to 4 per cent monthly interest.

Investigation revealed that crores of rupees were collected from clients/investors in cash, and these proceeds were then channeled out of the country through hawala transactions and shell companies.

The ED investigation has exposed the collection of over Rs 125 crore through banking channels and in cash, under the guise of investment for earning interest/commission.

–IANS

atk/arm