India’s total telecom subscriber base reached 1.192 billion by the end of January 2025, according to the latest data released by the Telecom Regulatory Authority of India. This marks a net addition of 2.1 million subscribers from December 2024, reflecting a monthly growth rate of 0.18 percent. The growth was primarily driven by the wireless segment, which now includes Fixed Wireless Access (5G FWA) subscriptions that were previously categorized under wireline. This reclassification significantly influenced growth dynamics across segments.

Wireless subscribers rose to 1.157 billion, up from 1.150 billion in December 2024, registering a monthly growth of 0.55 percent. In contrast, the wireline segment declined sharply by 4.24 million subscribers, dropping from 39.27 million to 35.03 million, showing a steep 10.80 percent monthly fall. This drop, however, is attributed to the adjustment in accounting for 5G FWA users, who are now included under wireless.

India’s tele-density stood at 84.54 percent by the end of January 2025, up marginally from 84.45 percent a month earlier. Urban tele-density slightly declined from 131.50 percent to 131.40 percent, while rural tele-density improved from 58.22 percent to 58.38 percent. Urban areas accounted for 55.69 percent of total subscribers, while rural regions contributed 44.31 percent.

The broadband subscriber base rose marginally from 944.96 million to 945.16 million, a monthly growth of 0.04 percent. This included 41.15 million wired broadband users and 904.02 million wireless broadband users. Wired broadband showed a slight decline of 0.09 percent, while fixed wireless broadband saw a notable drop of 4.39 percent. Mobile broadband usage grew by 0.05 percent.

Reliance Jio led the broadband market with 476.58 million subscribers, followed by Bharti Airtel with 289.31 million, Vodafone Idea with 126.41 million, BSNL with 35.77 million, and Atria Convergence Technologies with 2.28 million. These five providers together commanded a 98.43 percent market share in the broadband segment. In the wired broadband category, Reliance Jio also held the top spot with 11.48 million subscribers, while Airtel had 8.55 million and BSNL had 4.26 million.

The wireless broadband segment continued to be dominated by Reliance Jio with 465.10 million users, followed by Airtel at 280.76 million and Vodafone Idea at 126.41 million. BSNL accounted for 31.52 million subscribers. The wireless broadband market remained highly concentrated, with the top five players holding a 99.98 percent share.

In terms of active wireless subscribers, 1.065 billion were active on the peak Visitor Location Register (VLR) day in January 2025, representing 92.51 percent of the total wireless user base. Reliance Communication recorded a perfect 100 percent VLR activation, while MTNL had the lowest at 48.31 percent.

Wireless (mobile only) subscribers grew slightly from 1.150 billion to 1.151 billion. However, urban mobile users declined marginally by 1 million, while rural areas added 2 million users, showing a subtle urban-rural divergence. The mobile tele-density in India dipped to 81.65 percent from 81.67 percent. Urban mobile tele-density dropped to 123.92 percent, but rural density inched up to 58.05 percent.

5G FWA subscribers reached 5.72 million by January 2025, comprising 5.513 million in urban areas and 0.202 million in rural zones. The urban share of 5G FWA users stood at 96.46 percent.

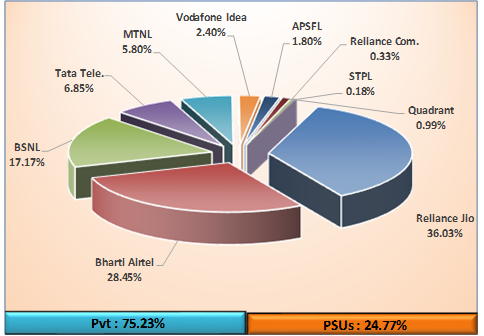

Wireline tele-density fell to 2.48 percent nationwide. The urban share in this segment was 92.03 percent compared to just 7.97 percent in rural India. BSNL, MTNL, and APSFL together held 24.77 percent of the wireline market.

The M2M cellular mobile connections, important for IoT applications, rose from 59.09 million in December 2024 to 63.09 million in January 2025. Bharti Airtel led this category with 33.04 million M2M connections, commanding a 52.37 percent market share. Vodafone Idea followed with 25.07 percent, Reliance Jio with 17.40 percent, and BSNL with 5.16 percent.

Mobile Number Portability requests in January 2025 stood at 14.14 million, bringing the cumulative total to 1.093 billion since the service’s inception. Zone-I, comprising northern and western regions, recorded 8.16 million requests, while Zone-II, covering the south and east, saw 5.98 million. Uttar Pradesh-East topped the charts with 108.37 million cumulative MNP requests, followed by Maharashtra with 89.08 million. In Zone-II, Madhya Pradesh and Karnataka led with 86.03 million and 72.50 million requests, respectively.

Among regional circles, all service areas recorded wireless subscriber growth in January 2025, except Himachal Pradesh, Punjab, Uttar Pradesh (West), Maharashtra, Delhi, West Bengal, Tamil Nadu, Andhra Pradesh, Jammu and Kashmir, and Kolkata. In the wireline segment, all circles showed a monthly decline, although yearly growth remained positive.

Circle-wise data revealed that Circle B (covering smaller towns and states) added the most wireless users with 2.56 million additions. However, it also saw the highest wireline decline with 1.65 million disconnections. Circle A and C followed with varying trends of decline in wireline and growth in wireless subscriptions. Metro circles, including Delhi, Mumbai, and Kolkata, added 0.62 million wireless users but lost nearly 0.39 million wireline users.

Delhi recorded the highest overall tele-density at 274.17 percent, while Bihar had the lowest at 56.63 percent. Eight telecom service areas reported tele-density below the national average of 84.54 percent.

With ongoing reclassification and market consolidation, India’s telecom sector continues to be dominated by a few large players. The inclusion of 5G FWA under wireless categories has aligned reporting mechanisms with emerging technological standards, offering a clearer picture of connectivity trends as the country transitions toward next-generation telecom infrastructure.