NITI Aayog has released an ambitious report, “Automotive Industry: Powering India’s Participation in Global Value Chains,” outlining a detailed roadmap to transform India into a global leader in the automotive sector. Despite contributing 7.1% to India’s GDP and ranking fourth in global vehicle production, the report highlights that India holds a modest 3% share in global automotive component trade, revealing immense untapped potential. It emphasizes integrating India’s automotive sector into global value chains as a vital step toward enhanced economic growth and global competitiveness.

The automotive industry, a cornerstone of India’s manufacturing ecosystem, accounted for the production of over 28 million vehicles in 2023-24, including 21 million two-wheelers and 6 million cars and commercial vehicles. This sector contributes significantly to India’s industrial output, supporting millions of jobs and serving as a major consumer of steel, electronics, rubber, and IT services. However, India’s limited penetration in high-value, high-precision segments like engine components and drive transmission systems, where its share in global trade ranges between 2% to 4%, calls for strategic intervention.

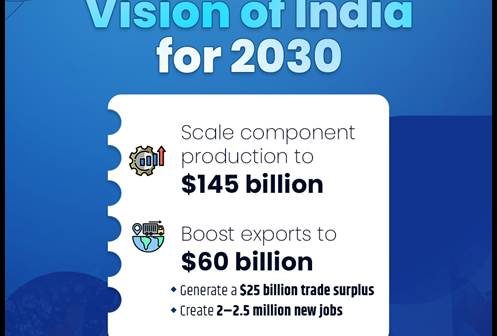

The global automotive component market, valued at $2 trillion in 2022, includes $700 billion in trade across borders. With targeted reforms, India aims to increase its share from $20 billion to $60 billion by 2030, achieving a $25 billion trade surplus and creating 2 to 2.5 million new jobs. This vision aligns with initiatives like Make in India and Atmanirbhar Bharat, which aim to bolster domestic manufacturing and self-reliance.

The report identifies global trends shaping the industry, including the rapid rise of electric vehicles (EVs), which saw China produce over 8 million EVs in 2023. EV adoption in the EU and the US is accelerating, driven by regulatory mandates and subsidies. These trends, combined with the increasing integration of AI, robotics, and IoT in manufacturing, underscore the growing demand for advanced materials and smart factory setups. Sustainability initiatives like BMW’s EV battery recycling and Volkswagen’s renewable energy sourcing further highlight the industry’s shift toward carbon neutrality and resource efficiency.

Major government schemes, such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) initiative, PM E-Drive Scheme, and the Production Linked Incentive (PLI) scheme, have already mobilized over ₹66,000 crore to support the transition to EVs and advanced automotive technologies. Specific targets under these programs include the procurement of 24.79 million electric two-wheelers, 3.2 million electric three-wheelers, and 14,028 electric buses, alongside the establishment of a robust public charging infrastructure.

The report also emphasizes India’s cost disadvantages compared to global competitors like China. Higher raw material and machinery costs, coupled with elevated logistics, financing, and energy expenses, contribute to a 10% cost disadvantage. To overcome these challenges, the report recommends fiscal measures, including operational expenditure support, skill development programs, and R&D incentives. Cluster development and the adoption of Industry 4.0 technologies are also proposed to enhance efficiency and foster innovation.

India’s automotive sector is poised at a critical juncture, where focused reforms and global integration can propel it into the league of global leaders. The execution of strategic interventions over the next five years will determine whether India emerges as a hub for high-value automotive components or remains confined to low-cost traditional segments. By aligning policy clarity with industry innovation, India aims to solidify its position as a globally recognized supplier of next-generation mobility solutions. The full report is available on NITI Aayog’s official website.