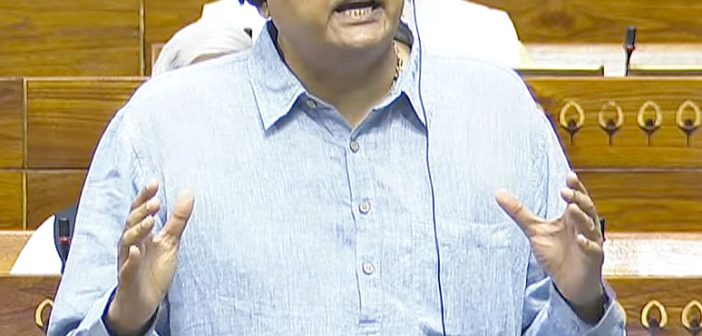

The Income Tax (No 2) Bill, 2025, passed in the Lok Sabha, is poised to overhaul India’s tax framework by simplifying compliance, reducing litigation, and enhancing economic growth. BJP leader Baijayant Panda, chairman of the Parliamentary Select Committee that reviewed the legislation, stated that the new Act will make taxes easier to understand and comply with, thereby cutting down disputes and legal complexity.

The revised Bill incorporates 285 recommendations from the Select Committee and replaces the Income Tax Act of 1961, which had accumulated over 4,000 amendments and more than 5 lakh words over the decades. According to Panda, the new legislation reduces the volume of the law by nearly 50 per cent, making it more accessible to individual taxpayers and MSMEs.

Finance Minister Nirmala Sitharaman, who tabled the updated Bill, explained that the revisions include corrections in drafting, alignment of phrases, consequential changes, and cross-referencing to ensure legislative clarity. The earlier version of the Bill was withdrawn to avoid confusion and to present a consolidated draft reflecting all necessary changes.

The new tax structure introduces revised slabs and rates across the board, with a particular focus on benefiting the middle class. The government expects the changes to leave more disposable income in the hands of taxpayers, thereby stimulating household consumption, savings, and investment.

Panda credited Prime Minister Narendra Modi’s leadership for the repeal and overhaul of over 1,500 outdated laws, contributing to India’s rise as the world’s fourth-largest economy. The new Income Tax Act is seen as a continuation of this reformist momentum, aiming to modernize India’s fiscal architecture and reduce the burden of legal ambiguity.