By Gopala Subramanian

In a damning indictment of India’s fragile banking architecture, a Right to Information (RTI) query filed by the All India Bank Employees’ Association (AIBEA) has exposed a staggering 1.19 lakh cases of banking frauds between 2022 and December 2024. The data, sourced directly from the Reserve Bank of India (RBI), reveals the grotesque scale of financial misgovernance, particularly in private banks, shattering the public’s trust in a system already teetering on the edge of credibility.

Private Banks: Leading the Fraud Parade

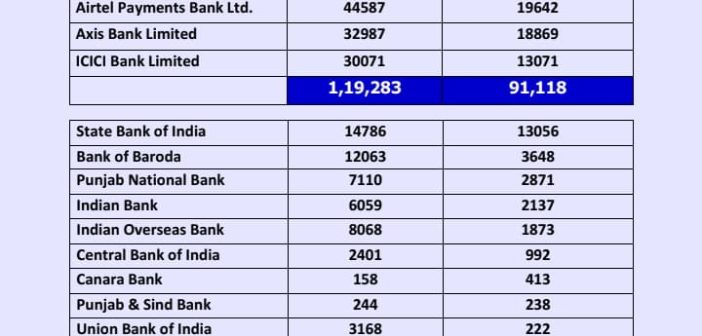

HDFC Bank, India’s largest private sector lender, reported a whopping 11,638 frauds in FY 2022–24, which has tripled to 39,536 cases by December 2024 alone. This explosion in fraudulent activities at one of India’s most trusted banking brands exposes the deep rot festering under glossy digital apps and billion-rupee advertising campaigns.

Airtel Payments Bank is not far behind in this ignominy. It registered a staggering 44,587 frauds in FY 2022–24, albeit dropping to 19,642 up to December 2024. While the dip appears encouraging on the surface, the volume itself is chilling—how could such an institution, entrusted with small savings of India’s poorest citizens, become a hotbed of deception?

Axis Bank and ICICI Bank report 32,987 and 30,071 frauds respectively during the same period. Although these figures drop to 18,869 and 13,071 in 2024–25 (up to Dec), they remain deeply troubling. These institutions, often portrayed as paragons of efficiency and technology-driven services, seem riddled with systemic vulnerabilities and opaque risk management.

Across these four leading private banks alone, the total fraud cases stood at an unthinkable 1,19,283 between 2022–2024, and a further 91,118 in just nine months of FY 2024–25—a level of financial mismanagement that borders on institutional negligence.

Public Sector Banks: Marginally Better, But Not Immune

State Bank of India, India’s largest bank by assets, reported 14,786 cases of fraud in the 2022–24 period, and 13,056 up to Dec 2024—a near-constant trend that suggests no major corrective reforms have been implemented. Bank of Baroda follows with 12,063 and 8468 cases respectively.

Other major nationalised banks such as Punjab National Bank (7,110 in 2022–24; 2,871 in 2024–25), Indian Overseas Bank (8,068 and 1,873), and Indian Bank (6,059 and 2,137) are also key offenders, although they remain dwarfed by the private sector in sheer scale.

Ironically, smaller PSBs like Punjab & Sind Bank, Canara Bank, and UCO Bank, while not entirely immune, registered relatively fewer frauds—under 500 per year on average. However, their smaller balance sheets offer little consolation for the pattern of carelessness that seems to permeate the entire state banking ecosystem.

The National Picture: A Colossal Failure

In total, public sector banks clocked 54,908 fraud cases between 2022–24, and 25,878 up to December 2024. Compared to the private banks’ 1.19 lakh frauds in the same period, this might suggest that PSU banks are more resilient—but that’s a dangerously misleading assumption. Many PSBs remain grossly under-audited, with weaker digital infrastructure and poor grievance redressal mechanisms—potentially hiding thousands more cases of undetected fraud.

The Bigger Tragedy: No Data on Monetary Losses

What makes this expose even more scandalous is the absence of quantified monetary losses. Nowhere in this RTI response are the actual financial losses—both individual and institutional—accounted for. AIBEA’s Mumbai office, which filed the RTI, expressed grave concern: “We are staring at a banking ecosystem where the number of frauds is disclosed, but the monetary implications are not. This is like reporting a murder but hiding the body.”

Given that even a small proportion of these cases involve thefts of ₹50,000 or more, the cumulative financial damage could easily run into thousands of crores. The psychological toll on defrauded customers—many of whom are senior citizens, farmers, and digital banking novices—is immeasurable.

A Culture of Denial and Impunity

Experts point out that Indian banking regulation is in urgent need of overhaul. Fraud detection remains reactive, not proactive. Audit trails are weak. Cybersecurity in smaller banks is antiquated. More damningly, there is no national fraud recovery fund. Most victims of banking frauds are left to navigate a tortuous maze of police complaints, legal proceedings, and stonewalled call centres.

The RBI, which routinely slaps banks with fines, has failed to make systemic reforms binding. Penalties are absorbed as operating expenses. No major banking CEO has faced criminal trial or jail time for the explosion of frauds during their tenure. The implicit message to perpetrators—especially internal fraudsters—is that the system tolerates, even enables, fraud as long as it doesn’t draw headlines.

AIBEA: Demands Urgent Action

The All India Bank Employees’ Association has demanded the following:

-

A parliamentary investigation into the rising fraud rates in Indian banks.

-

A centralised fraud reporting portal with customer-friendly recovery timelines.

-

Mandatory jail terms for internal fraudsters, irrespective of amount.

-

A public disclosure of monetary losses per bank, per year.

-

Greater whistleblower protection for banking staff who report internal fraud.

Conclusion: A Ticking Time Bomb

India’s banking sector, especially its private giants, are staring into an abyss of their own making. Flashy apps, rebranded logos, and celebrity endorsements can no longer conceal the fundamental truth: that behind every fraud is a victim, and behind every statistic, a system that failed.

Until there is accountability—not just data disclosure—this crisis will only grow.

India doesn’t need just banks. It needs trustworthy ones.